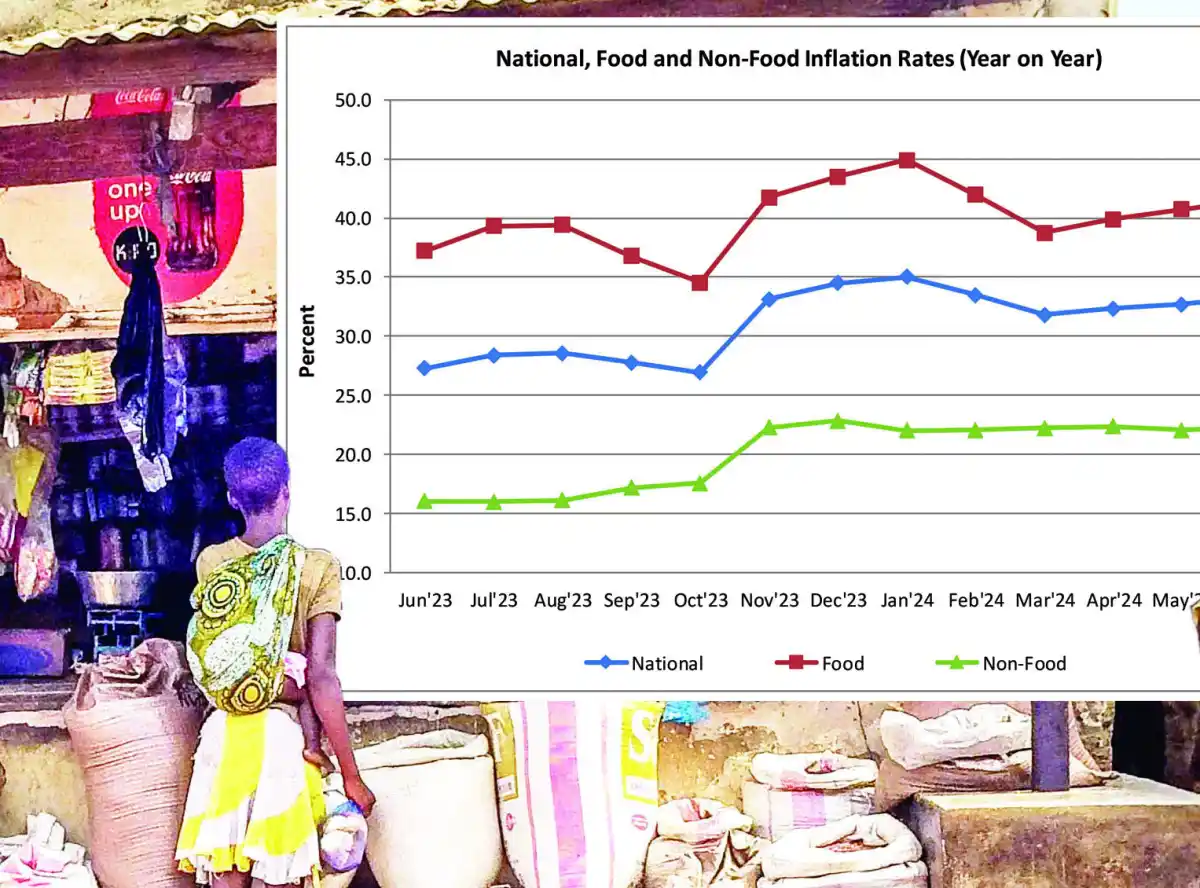

Purchasing power continues to erode in the country evidenced by rocketing headline inflation, seen at 33.3 percent in June from 32.7 percent in May, figures from National Statistical Office (NSO) show.

A statistical flash published by NSO yesterday indicates that food and non-food inflation rates are at 41.5 percent and 22.2 percent, respectively.

The national month-to-month inflation rate for June 2024 stands at 2.4 percent.

Food inflation rate is at 3.1 percent while non-food inflation rate is at 1.4 percent.

“The urban month-to-month inflation rate is at 2.5 percent. Urban food and non-food inflation rates stand at 3.3 percent and 1.5 percent, respectively. The rural month to month inflation rate is at 2.4 percent. Rural food and non-food inflation rates stand at 3.0 percent and 1.4 percent, respectively,” the flash reads.

June becomes the eighth month in a row with headline inflation remaining above the 30 percent 2024 average projected by Reserve Bank of the Malawi (RBM).

To achieve the projection, it will be required that the inflation be sustained below 30 percent for the remainder of the year.

In an interview, economist Marvin Banda said inflation is expected to remain elevated in the short term.

He said non-food inflation has, however, remained relatively stable indicating that the economy has not received any negative external pressures that may be large enough to trigger currency misalignments.

“The month-to-month inflation will continue to increase marginally unless major shocks to the macroeconomic fundamentals that have the greatest contributory weight on price determination such as exchange rate mechanism, which continues to experience misalignment, occur.

“If the economy can experience no shocks to macroeconomic fundamentals before November, it would see the annual inflation loop closed,” Banda said.

Another economist Velli Nyirongo said a surge in food prices poses a significant challenge to Malawian consumers.

He said the pressure is eroding purchasing power, compelling households to allocate a larger proportion of income towards essential goods and services.

He said consequently, the situation is reducing discretionary spending for Malawians, thereby exacerbating income inequality.

“Soaring food prices are contributing to food insecurity, especially within vulnerable communities. The inflationary environment is also undermining savings, hindering wealth accumulation and potentially eroding the middle class.

“It is important to mitigate the adverse consequences for consumers now before the situation is out of hand. The government must implement deliberate decisive policies to curtail inflation with urgency,” Nyirongo said.

Economics Association of Malawi President Bertha Chikadza said the higher inflation rate poses significant challenges to households.

“Policymaker s should closely monitor the inflation dynamics and consider appropriate measures to manage inflation, especially food inflation, and ensure macroeconomic stability in the country. This is in view of the fact that monetary authorities have been pursuing a tight policy stance to combat inflation but it is ineffective.

Chikadza said fiscal and monetary policy authorities should collaborate in managing the situation.

“This is because while monetary authorities are implementing a tight monetary policy, government borrowing is also on the increase, which is increasing money supply and subsequently inflationary; apart from rising food inflation and passthrough of imported inflation,” Chikadza said.

In an earlier interview, RBM Governor Wilson Banda hinted at a prolonged tight monetary policy stance in a quest to contain rising inflation in the economy.

He said this year has been a very difficult one considering the cyclones which culminated in a good area of the southern part of Malawi registering maize shortages.

Banda said the situation necessitated movement of maize – the country’s staple food – from various parts of the country to the Southern Region.

“We expect that as monetary policy authorities, we should not relent, we should not give up. We should continue tightening monetary policy,” Banda said. The Monetary Policy Committee is expected to meet this month.

0 Comments