Commercial banks in the country registered a steady increase in their combined assets from the year 2000, figures from the Reserve Bank of Malawi (RBM) show.

The trend, according to analysts, signals robust growth.

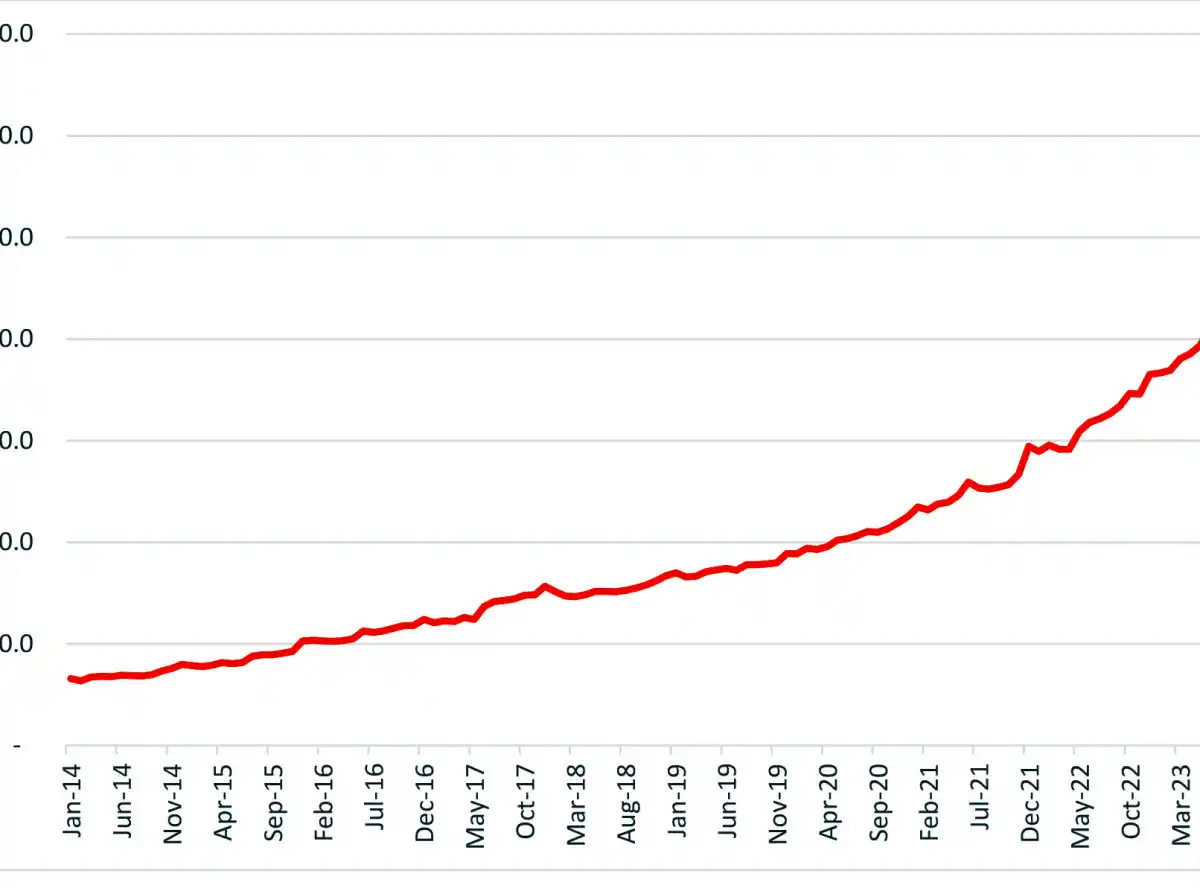

Data from the central bank show that within the past decade alone, commercial banks assets grew by 641 percent from K646.8 billion to K4.86 trillion.

Nevertheless, the assets have further accumulated to a record K5.86 trillion as at end May 2024.

The assets grew exponentially since 2022, a period in which RBM adopted a tight monetary policy stance.

However, the data also show that the commercial banking sector has experienced a significant increase in total liabilities which match the assets figures.

The ratio of assets to liabilities in commercial banks has fluctuated over the years, reflecting the sector’s efforts to maintain financial stability and manage risks.

Among other things, the liability lines include liabilities to the foreign sector, deposits of non-residents, liabilities to banks abroad, deposits of central government, deposits of statutory corporations, liabilities to RBM and liabilities to other domestic banks.

On the other hand, the asset lines include claims on foreign sector, claims on banks abroad, bills payable abroad, loans and advances to non-residents, official sector, claims on Government, claims on statutory corporations, claims on domestic banks, claims on RBM, deposits in RBM, currency in banks, RBM bills, claims on other domestic banks and claims on domestic private sector.

Asked whether the assets and liability situation does not affect shareholders, banking and finance expert Richard Tembo said the accounting equation provides that assets will always be equal to liabilities.

“If they are showing that the assets are equal to the liabilities, it means that they are standard,” Tembo said. In an earlier interview, President of Bankers Association of Malawi, who is also Chief Executive Officer of Standard Bank Malawi, Phillip Madinga, said a resilient banking sector remains essential for sustainable economic growth.

0 Comments