By Wezzie Gausi:

The Ministry of Finance maintains that the local economy is poised to rebound in the short to medium terms as the government continues working on interventions towards recovery.

Among other things, the Treasury says success in debt restructuring discussions with bilateral and commercial creditors would ease pressure in the fiscal space and create room to channel the resources towards growth interventions.

This comes at a time when the International Monetary Fund (IMF) has engaged the Treasury on the country’s performance under its Extended Credit Facility (ECF) programme.

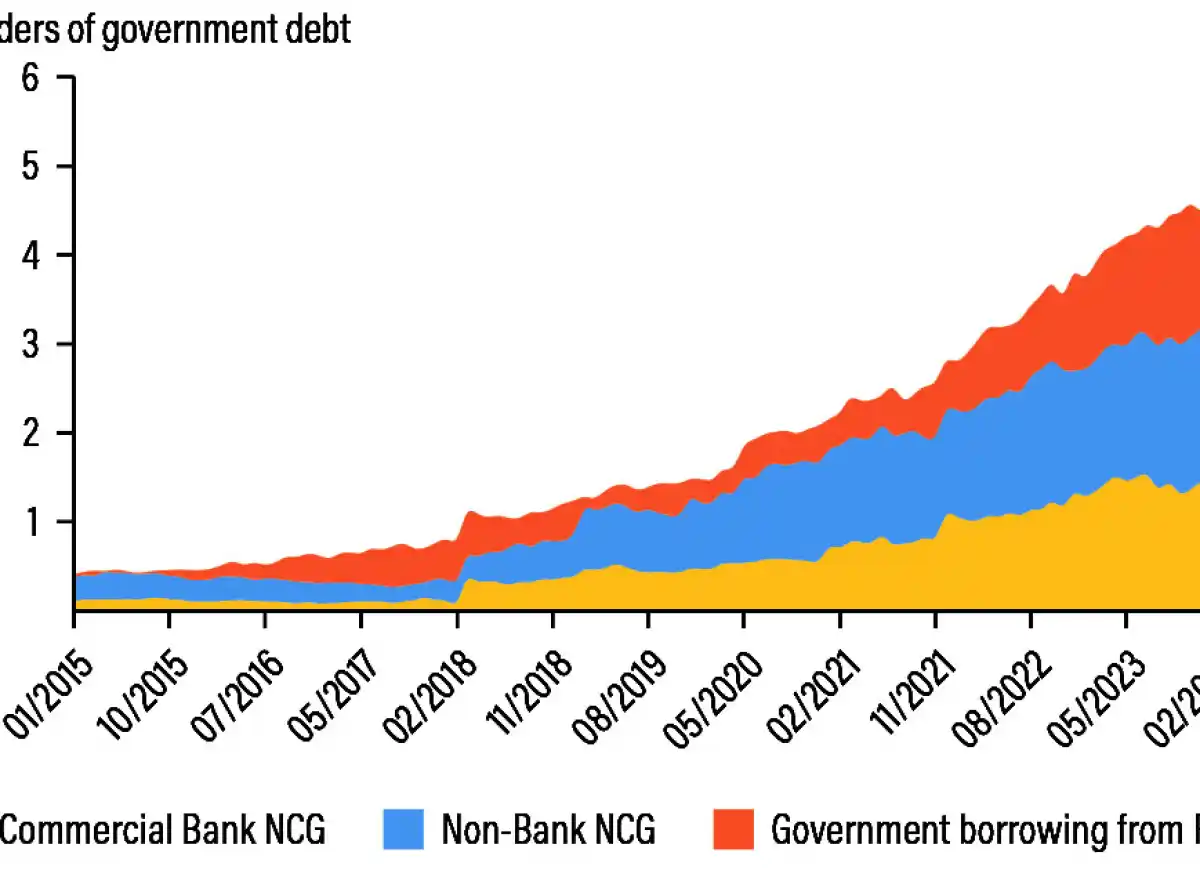

Among other things, the fund has been lamenting public debt as a hindrance to growth.

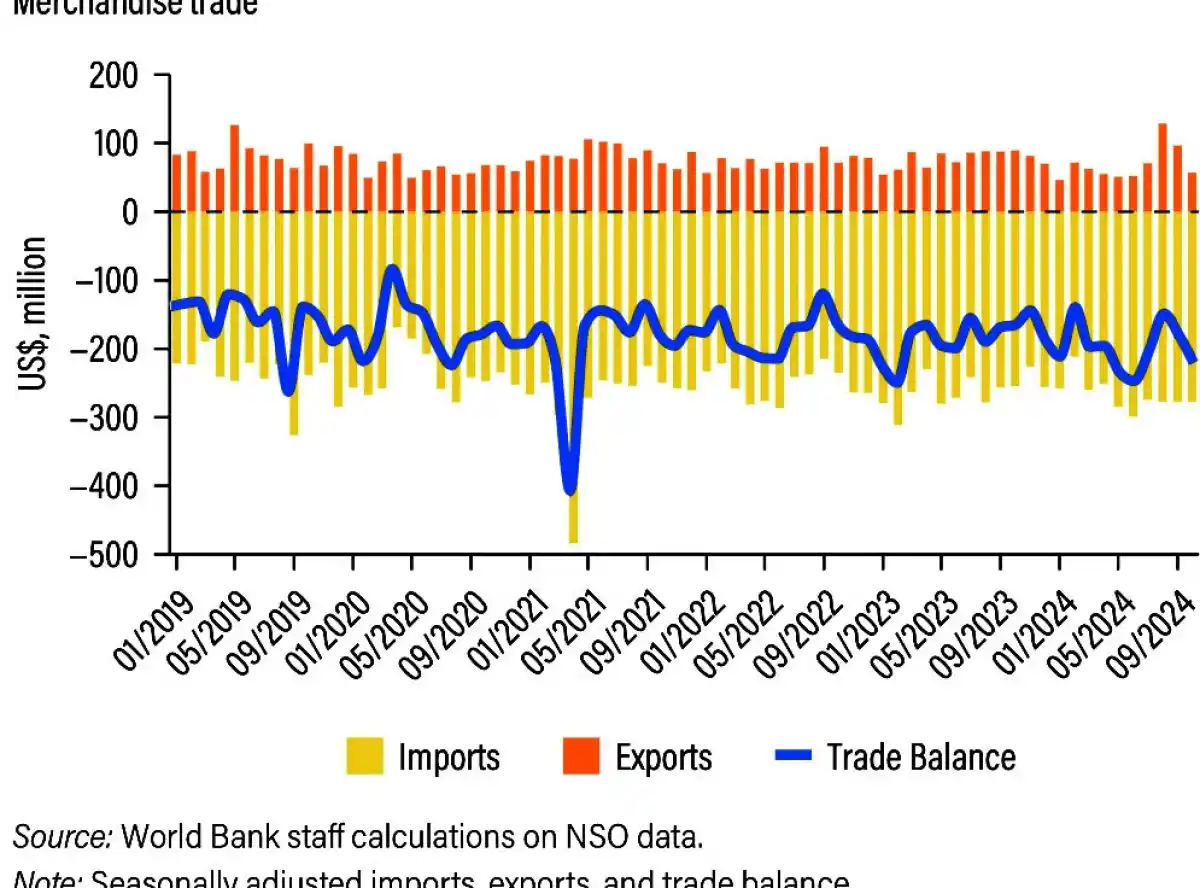

Recent figures show that Malawi’s debt to GDP ratio quickened from 81.3 percent in February to 91.3 percent fuelled by persistently large fiscal and external deficits and the depreciation of the Kwacha.

But the government has been engaging its creditors for a possible debt restructuring.

In an interview, Ministry of Finance spokesperson Williams Banda said talks with the IMF team focused on prospects.

“The transition to macroeconomic stability in Malawi is expected to occur in the short to medium term. Through the ECF, the country’s foreign reserves have seen significant improvement; though maintaining these gains remains a priority.

“This enhancement in reserves has facilitated the availability of essential resources such as fuel, medicines and fertilisers for the Malawian population,” he said.

Banda said the ECF has also played a pivotal role in unlocking aid from key development partners, including the World Bank.

In a separate interview, economist Marvin Banda said rising public debt remains a cause for concern despite the efforts deployed.

“The picture painted during the first quarter is discouraging because irrespective of the fact that we were riding the crest of the wave of the all-time high tobacco revenues, government revenue continued to underperform.

“The reason public debt remains an extraordinary burden is because any negative shift in macroeconomic variables distorts any effort to repay debt and its interest. For example, the external debt requirement for the year is $147 million which is subject to variances in the exchange rate,” Banda said.

Sources say an IMF team has noted that years of unsustainable domestic and external borrowing, coupled with multiple external shocks, have exacerbated the country’s macroeconomic imbalances.

This is resulting in Malawi facing a $1.5 billion funding gap that needs to be addressed between 2023 and 2027 for the ECF to be effective.

The Reserve Bank of Malawi downgraded its 2024 growth estimate for Malawi to 2.3 percent from an earlier projection of 3.2 percent.

0 Comments