By Kingsley Jassi:

The National Statistical Office (NSO) has hinted that the forex situation, online trading and the entire informal market contribute to missing sources of financing in the Balance of Payment (BoP).

The NSO was reacting to concerns raised by the World Bank in its recent Malawi Economic Monitor (MEM), in which it observed high net errors and omissions—in some cases involving large payment transactions— causing clarity concerns in BoP figures.

But in a written response, NSO spokesperson Sam Chipokosa defended the data, saying the errors and omissions in the national accounts are below the acceptable threshold of five percent of nominal gross domestic product (GDP), hence the credibility issues should not arise.

However, NSO agrees that the absence of clarity on financing of imports affects net errors and omissions because, statistically, the sources of net errors and omissions in the compilation of External Sector Statistics can possibly be from any account on BoP.

“Besides, another source of incompleteness of financing data could be the informal sector, which undeniably may be what is practically happening within the prevailing environment of inadequacies in foreign exchange availability.

“It may only be the quantification that would be a challenge without conducting a thorough assessment,” Chipokosa said.

He further said NSO had been having challenges to conduct regular surveys to improve data quality.

He was quick to say collaboration that exists now between the NSO and Reserve Bank of Malawi has enhanced data quality through financing of BoP major surveys.

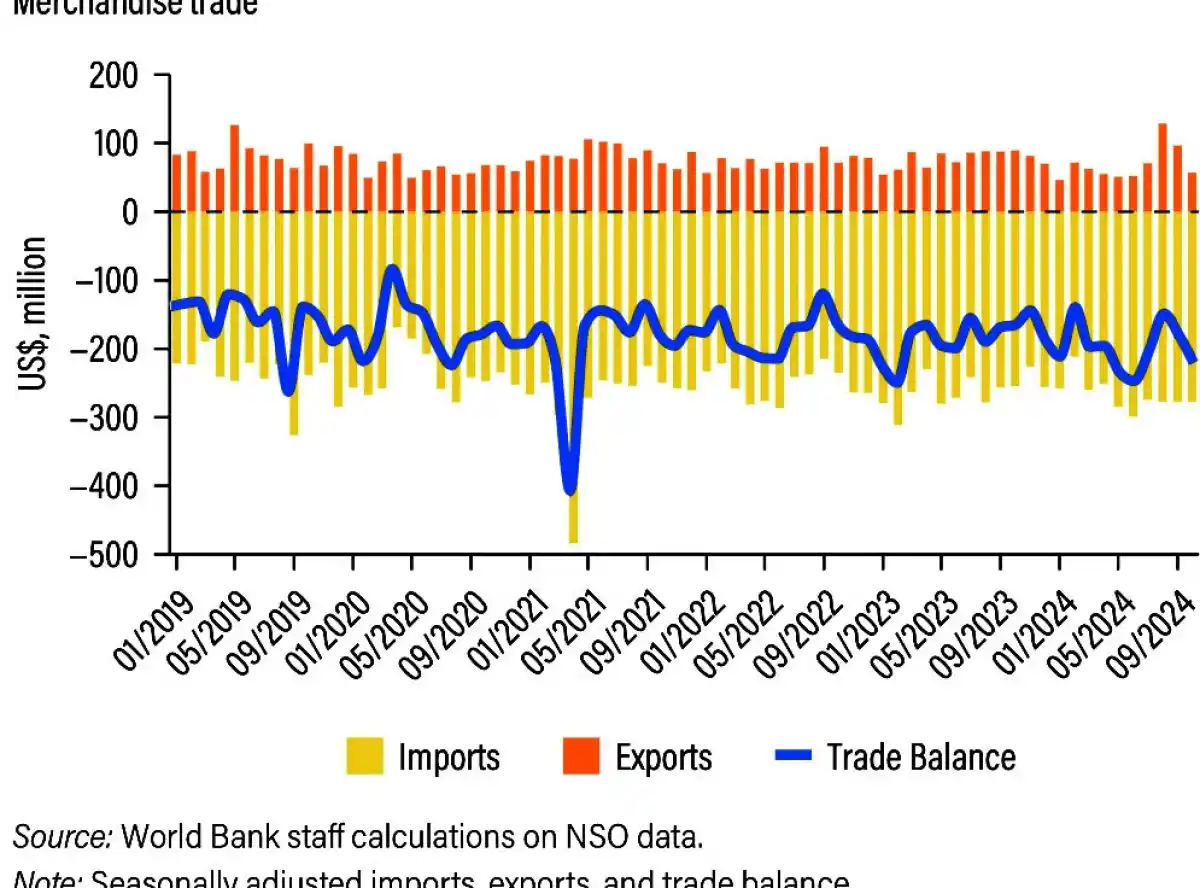

The major financing sources characterising the country’s BoP accounts are exports, grants (both capital and current), loans, foreign direct investment and international reserves, according to the NSO spokesperson.

“Some of the measures we are putting in place to address exhaustiveness in financing mechanisms include planning to resuscitate a survey on non-profit institutions serving households; planning to implement an informal sector survey; accelerating [the] use of mirror data with international trading partners; exploring the magnitude of remittances from Malawians in the diaspora, including the government’s labour export programme,” he said.

In its observation in the MEM, the World Bank said there were omissions and errors involving large payment transactions.

“Large net errors and omissions in the Balance of Payment indicate a lack of transparency around the financing of the current account,” the bank observes.

The bank further observes in the report that unrecorded transactions were captured, including informal or illegal activities, saying they may also reflect inaccuracies in data collection and reporting.

According to NSO, for Malawi, the practical cut-off point for the measure of assessment regarding acceptable NEO is at most 5 percent of nominal GDP, saying the October 2024 update of the BOP accounts registered 3.6 percent.

0 Comments