By Kingsley Jassi:

The treasury added to its debt stock at least K172 billion in January through issuance of debt instruments of different maturity periods.

In the last quarter of the 2024-25 financial year, the government plans to borrow K400 billion using the instruments.

An analysis of the debt instruments issued in the month shows that the Reserve Bank of Malawi (RBM), which handles Treasury’s borrowing activities on the market, had a busy period raising a total of K172 billion at face value through the bonds.

Debt instruments’ face value amount is what the bondholder expects at the maturity point and the issued bonds have maturity periods of between 1 and 10 years at coupon rates of between 11 and 15 percent.

Some Treasury notes, with maturity period from two and more years, are for infrastructure development while others are intended to settle matured debts.

Treasury bills have short maturity periods of between one and two years, and are usually issued to raise funds for budget operations.

It is understood that the treasury has been struggling with low cash flow, affecting financing obligations in the implementation of the current budget, leading to the high rate of borrowing.

The World Bank has so far observed that in the first half of the current fiscal year, the treasury borrowed K1.4 trillion, about K300 billion more than what was budgeted in the period.

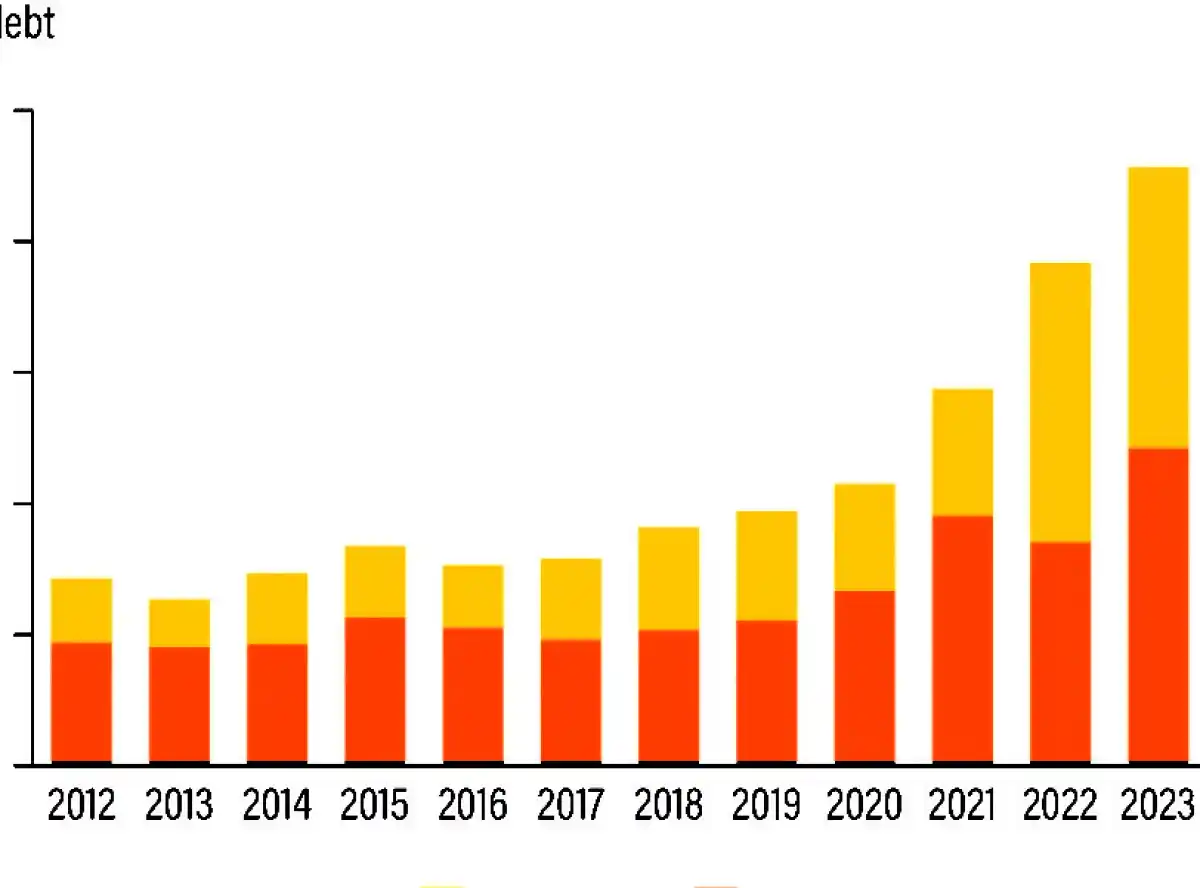

The bank observes that the public debt stock growth is being driven by large primary deficits, exchange-rate pressure, and unrecorded obligations, reflecting years of expansionary fiscal policy.

The bank further observes that high-value legal settlements, particularly related to pharmaceutical and fertiliser contracts, have been securitised, directly adding to the debt stock.

The government has also been urged to scale down expenditure in the next budget as a step towards addressing the debt crisis, currently estimated at 85 percent of the GDP.

Former RBM governor Elias Ngalande suggested, recently, that the government should draft a zero defect budget while calling for sealing of leakages in the public finance management system.

However, Finance Minister Simplex Chithyola Banda hinted, during the pre-budget consultations, that he would narrow the fiscal deficit in the next budget.

0 Comments