Malawi’s headline inflation—the rate at which commodity prices change at a given time in an economy—increased by 0.4 percentage points in July to 33.7 percent, National Statistical Office (NSO) figures show.

It was expected that inflation would remain elevated due to rising food prices.

In its Consumer Price Index issued last week, NSO shows that food inflation went up during the month under review to 41.9 percent. Non-food inflation for July stood at 22.4 percent.

Comparatively, the urban month-to-month inflation rate is at 1.3 percent while the rural month-to-month inflation rate is at 2.5 percent.

Rocketing inflation in recent months has eroded efforts to grow the country’s middle-income group but pushed low-income earners into ultra-poverty, according to economic experts.

Local economic think-tank, the Economics Association of Malawi (Ecama), feels the rise in inflation poses serious challenges to households, especially those with lower incomes.

In an interview yesterday, Ecama President Bertha Chikadza said rising inflation continues to erode purchasing power.

“This means the rise in inflation might exacerbate poverty of the already poor population and might also make a certain population fall in poverty, thereby compromising the government’s poverty reduction strategies,” Chikadza.

She said the safety nets which are in place should be intensified to ease the problems which the poor population is facing in the interim.

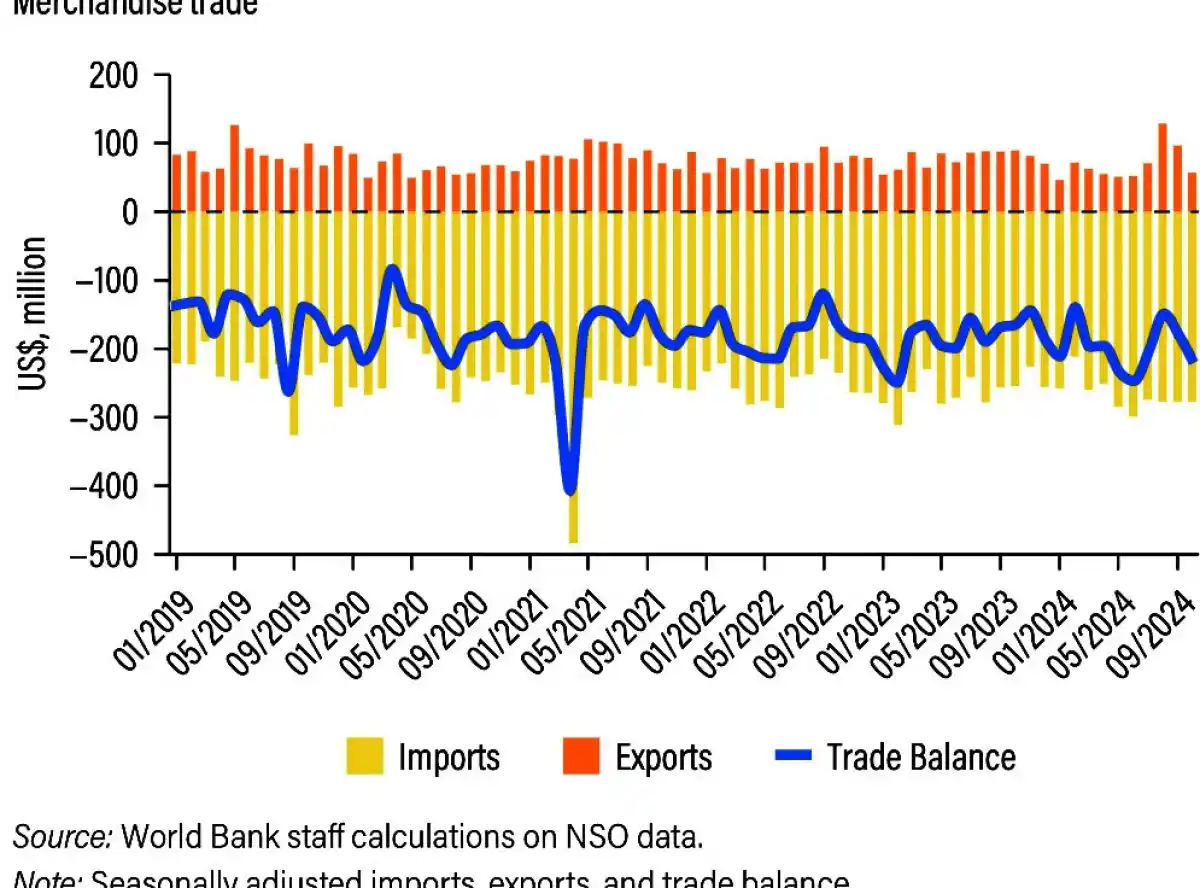

Chikadza attributed the ever rising inflation to lack of availability of food and the country’s insatiable appetite for imports, coupled with some macro and fiscal problems.

“If we make food, especially maize, available, and contain our imports of non-essential commodities, then we should be able to contain food inflation and pass through imported inflation which is part of non-food inflation. This will subsequently bring the core inflation down.

“On the other hand, we also need fiscal consolidation on the part of the government which, among others, should be a reduction in borrowing and consumption spending and also monetary policy which speaks to fiscal policy to correct the macroeconomic problems which contribute significantly to rising inflation,” Chikadza said.

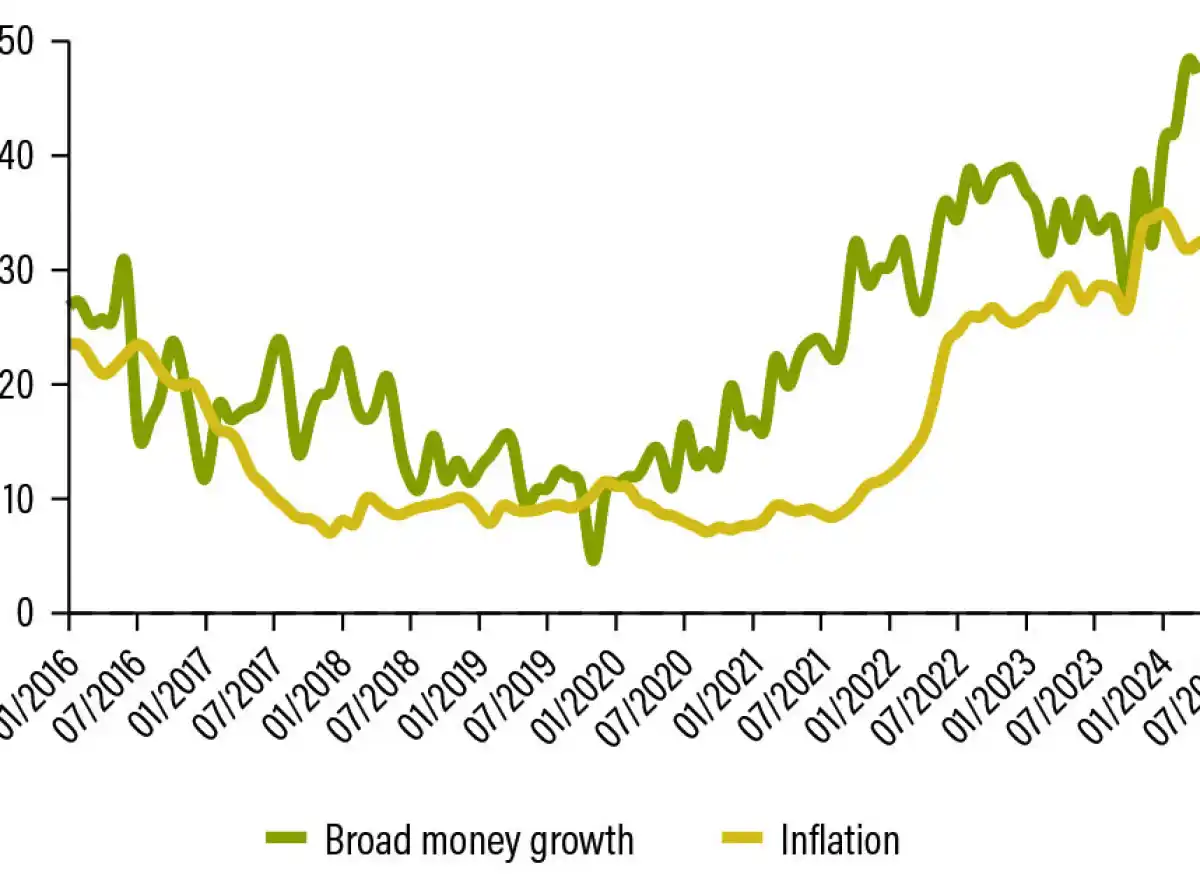

In its 19th edition of the Malawi Economic Monitor (MEM)—a bi-annual report that provides an analysis of economic and structural development issues—the World Bank projected the headline inflation to average 30 percent in 2024.

The World Bank says diminished agricultural output and continued upward pressure on food prices this year is eroding the disinflationary impact of tighter monetary policy the central bank adopted.

Malawi faces acute food shortage this year with over 4.2 million people at risk due to El Niño-induced drought and flooding in some parts.

Scarcity of maize, Malawi’s staple crop, has piled pressure on market price which has risen by an average of 64.5 percent between April and July 2024.

The surge has also weighed heavily in the Consumer Price Index, a basket for computing inflation, leading to a rise in food inflation.

The Britton Woods institution’s estimate is, however, lower than a 33.5 percent recently revised annual inflation estimate by the Reserve Bank of Malawi (RBM).

In its recent Monetary Policy Statement, RBM said rising food inflation continues exerting pressure.

Figures in the statement, however, show that headline inflation in the second quarter of 2024 averaged 32.8 percent, 0.6 percentage points lower than 33.4 percent in the previous quarter.

This followed easing in pressure on food inflation which declined to an average of 40.7 percent, having averaged 41.9 percent during the first quarter of 2024.

0 Comments