National Investment Trust Plc (NITL) has reported a significant financial performance for the year 2023, posting a profit after tax (PAT) of K21.50 billion.

This marks an increase from K6.99 billion in 2022, representing a 207.49 percent rise.

NITL Board Chairperson, Esther Gondwe, said this during a stakeholders’ engagement meeting held in Blantyre on Tuesday.

“The upward trajectory is a testament to our commitment to disciplined investing, prudent risk management and adherence to ethical principles,” Gondwe said.

NITL is listed on the Malawi Stock Exchange (MSE), and its shares are traded on the MSE, thus creating a secondary market subject to market forces.

Gondwe said the NITL’s strategic plan aims to rebalance its portfolio to encourage broader public participation in equity investments in Malawi.

“Our investment philosophy revolves around a long-term, research-driven approach to identify opportunities with attractive risk-return profiles. We maintain a diversified portfolio across asset classes and sectors to mitigate risk and capitalise on emerging trends,” she said.

Gondwe said the growth was largely driven by substantial share revaluation gains of K20.40 billion, up from K6.58 billion the previous year, and an increase in dividend income to K1.41 billion from K713.69 million in 2022.

“Our investment assets grew to K45.27 billion from K24.33 billion in 2022, reflecting an 86.04 percent year-on-year increase. The gross annualised return stood at 89.10 percent, significantly outperforming the Malawi All Share Index (MASI), which delivered a return of 78.85 percent in 2023, up from 19.89 percent in 2022,” she said.

For the year ending December 31, 2023, NITL declared an interim dividend of K202.50 million, up from K108.00 million in 2022.

She said NITL directors proposed a final dividend of K675.00 million, to be presented for approval at the upcoming annual general meeting.

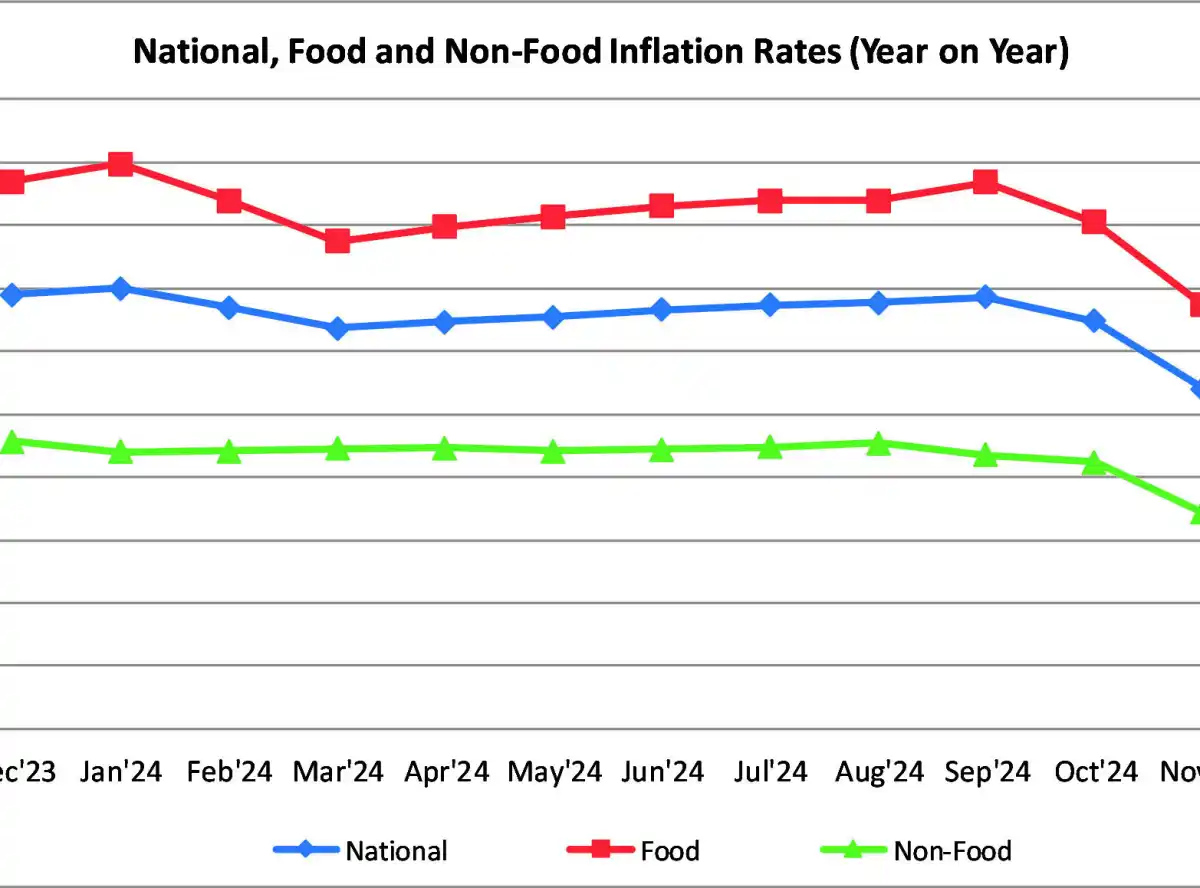

“The economic outlook for 2024 remains challenging, with rising inflation, high interest rates and a volatile forex market. However, we remain optimistic about the ability to navigate these challenges and continue delivering value to investors,” she said.

Frank Harawa, General Secretary of the Minority Shareholders Association of Listed Companies, praised NITL’s approach.

He said NITL must provide an accessible platform for individuals who might not have financial literacy to participate in the stock exchange.

“NITL must advocate for a lower entry barrier for stock market investments by allowing individuals to invest smaller amounts collectively. This collective investment approach enables more people to participate,” he said.

0 Comments