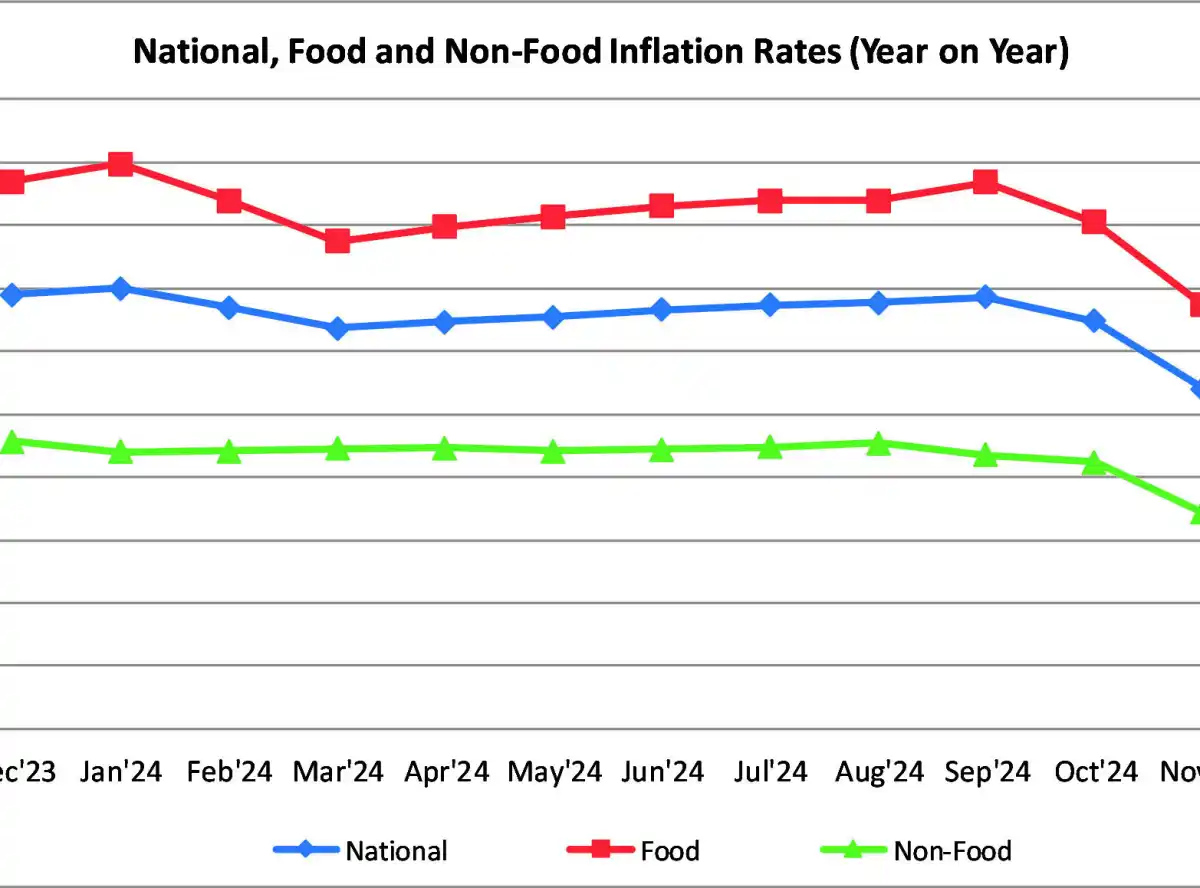

Malawi’s annual average inflation rate increased to 32.2 percent in 2024 from 28.8 percent recorded in 2023, latest figures from National Statistical Office (Nso) show.

According to the Stats Flash released Wednesday, average food inflation surged to 40.2 percent from 37.1 percent while non-food inflation climbed to 21.2 percent from 18.8 percent during the period.

This represents a 3.4 percentage point increase in overall inflation and indicates persistent pressure on prices throughout 2024.

The stats further show that headline inflation increased to 28.1 percent in December 2024 from 27 percent in November, driven by rising food prices.

Food inflation rose to 35.6 percent from 33.7 percent while non-food inflation eased to 16.8 percent from 17.2 percent during the month.

“The national month-to-month inflation rate for December 2024 stands at 4.5 percent. Food inflation rate is at 6.2 percent while Non-Food inflation rate is at 1.7 percent. The urban month to month inflation rate is at 4.3 percent.

“Urban Food and Non-Food inflation rates stand at 6.3 percent and 1.7 percent, respectively. The rural month to month inflation rate is at 4.7 percent. Rural Food and Non-Food inflation rates stand at 6.2 percent and 1.7 percent, respectively,” the Stats Flash reads.

In an interview, Economics Association of Malawi (Ecama) president, Bertha Bangara Chikadza said the slight increase in food inflation has contributed to the 1.1 percentage point increase in year-on-year inflation rate from 27 percent in November 2024 to 28.1 percent in December 2024.

She added that the rise in inflation from 27 percent in November to 28.1 percent in December is not surprising as food prices rose slightly in December, leading to this rise in inflation.

“As food inflation is going up, it is expected that headline inflation will also go up. It is time that the government should intensify the distribution of relief maize, and also open more Admarc depots. Food prices are likely to go up, with most fields having been affected by the dry weather in the months of November and December.

“The dry weather stunted most maize crops in many districts. This is likely going to negatively affect maize productivity. Government should be proactive, and start preparing early as maize shortage is likely to occur again this year and maize prices are likely to go up,” Chikadza said.

In a separate interview, economist Velli Nyirongo said the inflation trends suggest significant challenges for Malawi’s economy and its consumers.

He said food inflation, at 35.6 percent, remains significantly higher than non-food inflation at 16.8 percent, highlighting the disproportionate burden on food prices.

“These trends reflect an escalating cost of living, particularly for lower-income households that spend a significant portion of their income on food. Consumers face weakened purchasing power as inflation erodes the real value of income, making basic goods and services less affordable.

“Rural households are especially vulnerable, as they contend with higher food price increases alongside challenges such as the rising costs of agricultural inputs. Urban-rural disparities in inflation exacerbate existing inequalities, with rural areas facing steeper price pressures.

“For the broader economy, high inflation creates pressure on the Reserve Bank of Malawi to implement tighter monetary policies, such as raising interest rates, which may further slow economic growth. Prolonged inflationary trends, particularly in food prices, could fuel social unrest as the public demands’ government intervention,” Nyirongo said.

Recently newly appointed Reserve Bank of Malawi (RBM) Governor MacDonald Mafuta Mwale said inflation will gradually decline, although the path to price stability will be uneven.

“I am determined to address supply-side constraints so that we can fast track the disinflation process. That is why I will work with everyone in the policy and production value chains.

“We have already started to closely work with banks to diversify their lending to some selected high-growth sectors. This will ensure that banks play a vital and rightful role in financial intermediation thereby contributing to a more stable economic environment,” Mwale said.

RBM maintains a medium-term inflation target of five percent, although analysts say this remains challenging given persistent food price pressures and economic headwinds.

0 Comments