Financial Stability Report published by the Reserve Bank of Malawi (RBM) for the six months period ended June 30 2024 has shown an increase in non-performing loans (NPLs), mainly dominated by large enterprises.

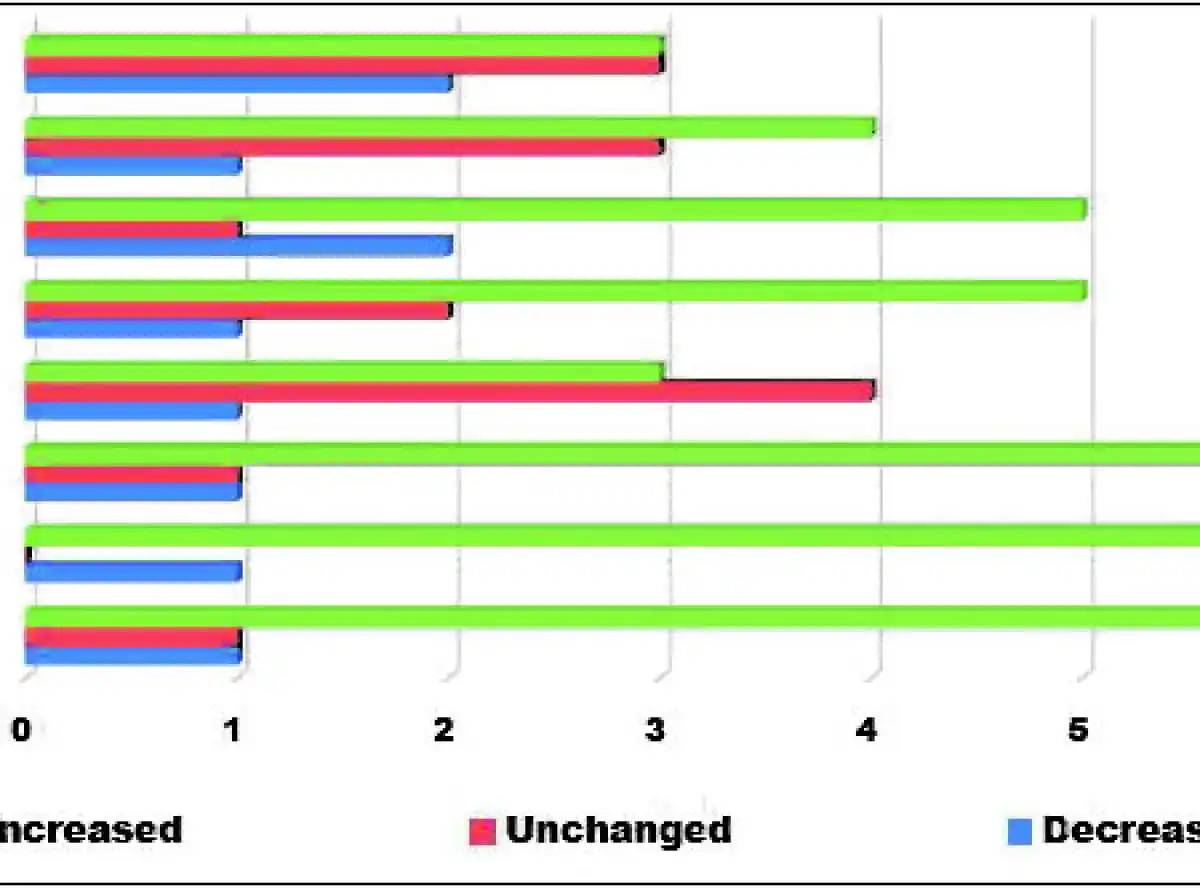

The report indicates that a majority of the banks perceived an increase in NPLs by large enterprises.

The findings show that four out of the eight banks perceived an increase in NPLs for large enterprises, while the remaining four indicated that NPLs remained unchanged.

The development has since been attributed to the slowdown in business and the eroded disposable incomes.

Six of the eight banks reported that NPLs increased while one indicated that NPLs remained unchanged.

However, one bank indicated a decrease in NPLs.

The NPLs were concentrated in four sectors, namely wholesale and retail trade, restaurants and hotels, community, social and personal services, and agriculture, forestry, fishing and hunting.

“It is particularly concerning that NPLs remain prevalent in sectors receiving significant credit,” the report reads.

Looking forward, most banks see an increase in NPLs within the banking system from July to December 2024.

This outlook is largely driven by anticipated continued deterioration in macroeconomic fundamentals, including rising inflation and interest rates, declining disposable incomes, the effects of local currency realignment, and persistent forex shortages,” the report reads.

The development threatens commercial bank profitability as high levels of NPLs force banks to increase their loan loss provisions.

In a recent interview, economist Marvin Banda said the risk inherent in the banking sector was leading to lending strategies that were crippling the private sector.

According to Banda, the macroeconomic crises the country is reeling from are manifesting in penalising private sector borrowing because they belong to the high-end risk spectrum as compared to the public sector, which is why even public sector employees are benefiting from government affiliation.

0 Comments