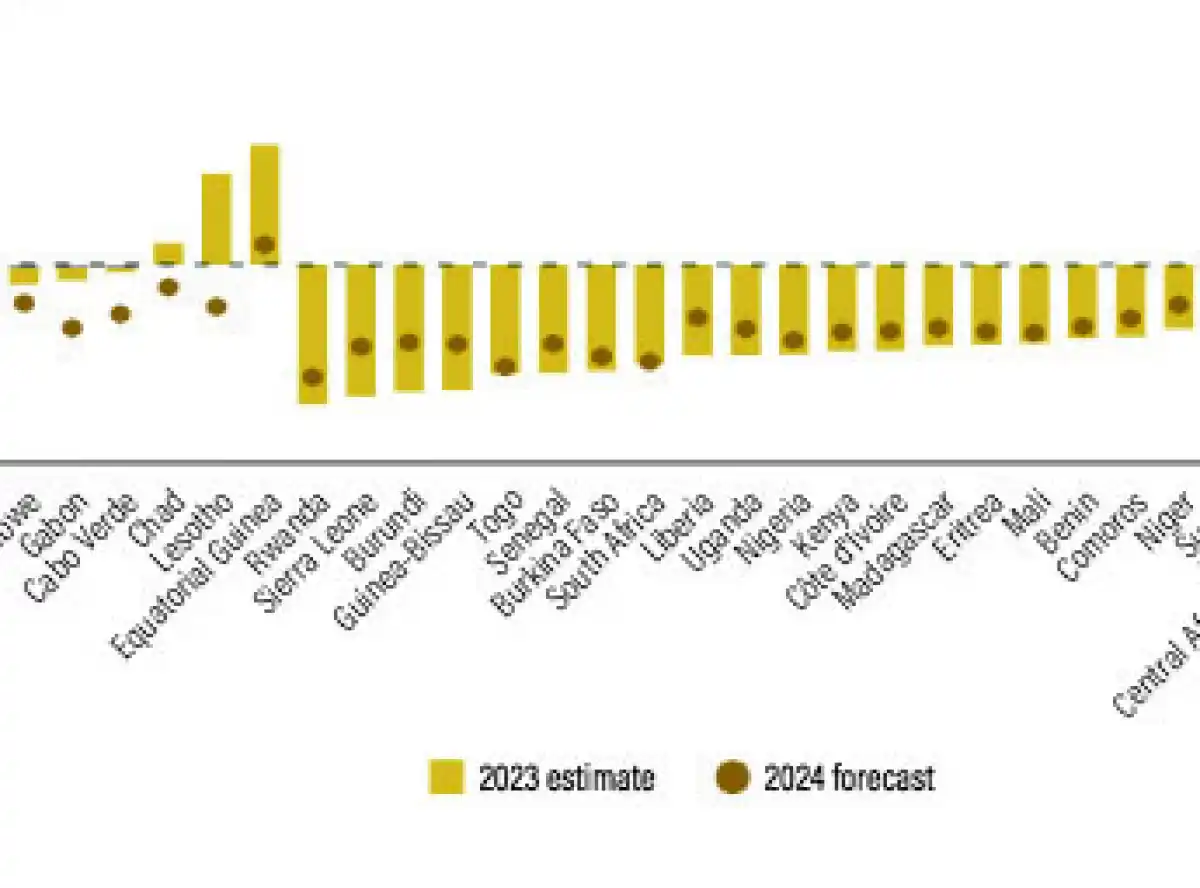

Malawi is on the path towards having one of the highest fiscal deficits in sub-Saharan Africa this year, figures contained in the recent World Bank’s Malawi Economic Monitor (MEM) show.

In the bi-annual report, the Bretton Woods institution warns that persistent fiscal slippages could jeopardise the country’s economic recovery.

Estimated at K5.98 trillion, the 2024-25 national budget has a K1.43 trillion deficit, which represents 7.6 percent of Malawi’s gross domestic product and the government plans to finance the gap through domestic borrowing amounting to K1.28 trillion with about K150 billion to be borrowed from external sources.

But the World Bank says while the budget targets a primary surplus in line with the International Monetary Fund (IMF) ECF programme prescriptions, fiscal discipline must be strengthened to avoid further slippages.

The budget rests on optimistic revenue assumptions related to budget support and tax collection.

Total expenditures are projected to decline by 3.7 percent of GDP, while tax reforms, improvements in revenue administration and rising budget support are expected to yield a 0.8 percentage-point increase in revenues.

“These expectations are also subject to significant downside risks…

“Underperformance on the revenue side could necessitate further borrowing and potentially monetary financing, impeding efforts to rein in inflation,” the World Bank says in the report.

According to the World Bank, financing the deficit necessitates greater domestic borrowing.

In the first quarter of this financial year alone, the government was earmarked to borrow K581.442 billion from the domestic market—an equivalent of 48 percent of the total amount it intends to borrow for the whole financial year.

In the 2023-24 financial year, the fiscal deficit significantly exceeded the levels anticipated both in the approved budget and in the mid-year revised budget.

It reached 12.4 percent of GDP, about two percentage points higher than that of the year before.

Expenditure overruns drove the widening of the deficit, with spending levels exceeding the approved budget by 10.6 percentage points of GDP due to the RBM recapitalisation and overspending on the wage bill, subsidies and other recurrent costs.

The World Bank fears that successive fiscal deficits could continue to contribute to the sustained accumulation of domestic debt, with outstanding balances reaching 31.9 percent of GDP at end- 2023.

Debt service consumes 32 percent of revenue (6.5 percent of GDP), narrowing the scope for productive investment and social spending. Speaking when presenting the national budget, Finance Minister Simplex Chithyola Banda affirmed the government’s commitment to working towards further narrowing the budget deficits.

0 Comments