The World Bank has indicated that commercial banks, exporters and investors continue to be reluctant to convert their foreign exchange holdings into Kwacha due to uncertainty.

This is contained in the recent Malawi Economic Monitor (MEM), a bi-annual publication of the Bretton Woods institution.

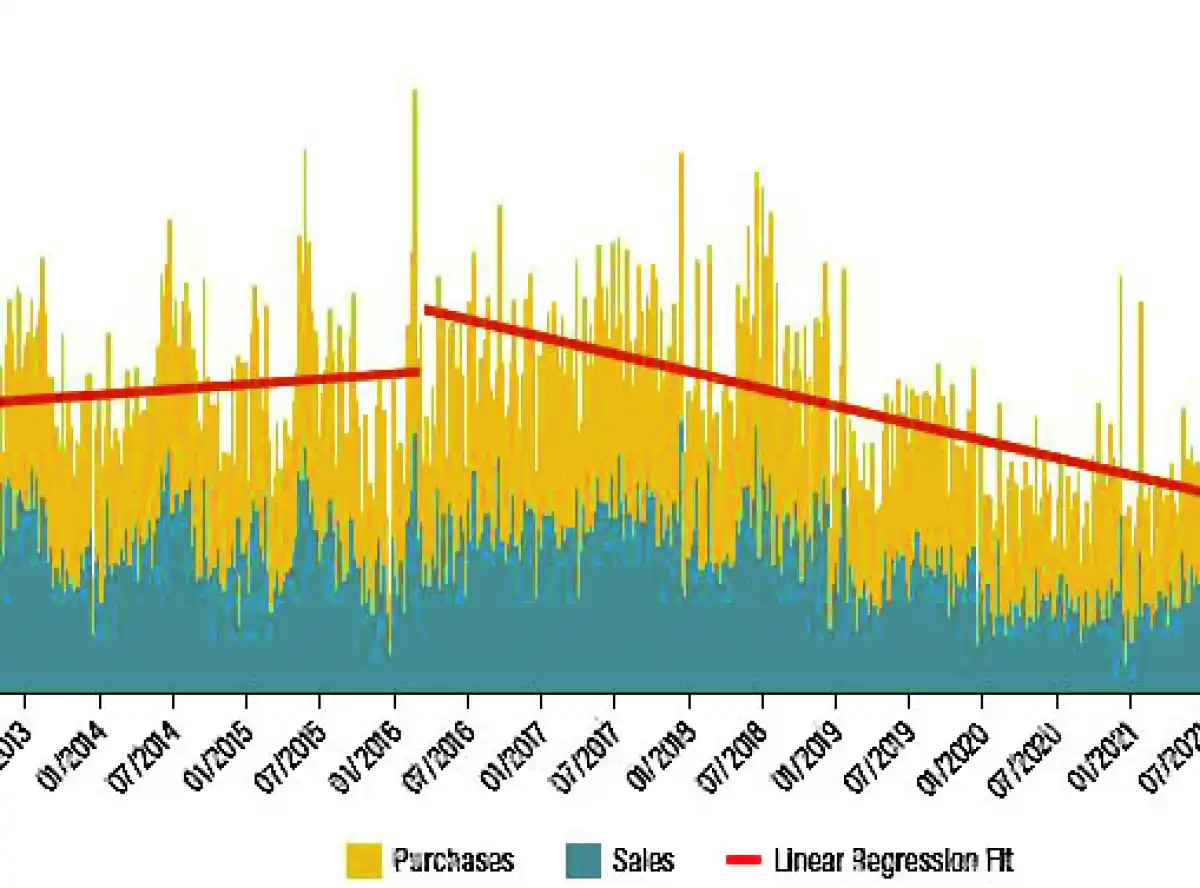

According to the publication, Malawi’s real exchange rate has appreciated since the start of 2024, but foreign exchange liquidity has remained low.

It further notes that after the rapid depreciation that followed the devaluation of the Kwacha in November 2023, the real exchange rate appreciated again since the start of 2024.

“Inflation in excess of 30 percent, coupled with a stable official exchange rate, has made it challenging to increase the supply of foreign exchange. There are many factors that could explain this, including on the supply side, as well as the higher rates offered in informal parallel markets.

“As a result, foreign-exchange liquidity among Malawian banks has been stagnant in recent months and foreign exchange sales to authorised dealer banks by the RBM since early 2023 have been unable to satisfy demand,” the MEM reads.

In an interview, Reserve Bank of Malawi Governor Wilson Banda said increased earnings from tobacco sales this year and a good relationship with development partners fit into the supply of foreign currencies.

“Ideally, the exchange rates should be very stable. But what is happening in our market is that speculators are basically saying, ‘I can make a little more cash by pushing the exchange rate to a certain level’.

“Then you find that there’s panic in the market. People go for those higher prices of foreign exchange and that fits into the black market rates and the like. So, for us, the black market rate has largely been driven by speculation more than anything else. We don’t think there is justification really to support that,” Banda said.

In a separate interview, Minister of Finance Simplex Chithyola Banda said there is a need to diversify economic activities to boost reserves.

“Some of the strategies that we have put in place are now paying dividends. For example, we’ve already started realising proceeds from carbon financing. We are able to sell and inject the proceeds into the national economy. Furthermore, we have signed Mining Development Agreements which gives us hope and optimism of generating a lot of foreign exchange from next year.

“We have financed the National Economic Empowerment Fund and plan to go into commercial farming,” Chithyola-Banda said.

RBM’s daily Financial Market Developments report, issued on Wednesday, shows that total foreign exchange reserves—an aggregate of foreign exchange reserves under the direct control of the central bank, authorised dealer banks and foreign currency denominated account holders—were seen at $572.02 million or 2.29 months of imports at the end of July.

This is a decline from $591.51 million import cover or 2.37 months of imports recorded at the end of the month of June.

0 Comments