By Benadetta Chiwanda Mia:

A National Payment Systems report published recently by the Reserve Bank of Malawi shows a mixed performance on the systems, with overall transaction volumes and values decreasing compared to the previous quarter while digital payment services illuminate growth.

According to the report, the total number of transactions processed across various payment streams decreased by 2.6 percent to 396.3 million, while the total value dropped significantly by 22 percent to K30.7 trillion.

This decline has been attributed to low economic activity, government austerity measures and reduced interbank borrowing due to improved banking system liquidity.

It further shows that despite the overall downturn, Digital Financial Services (DFS) demonstrated resilience as the volume of DFS transactions declined slightly by 2.5 percent to 385.9 million while the value of DFS transactions saw a minor decrease of 0.8 percent to K6.9 trillion.

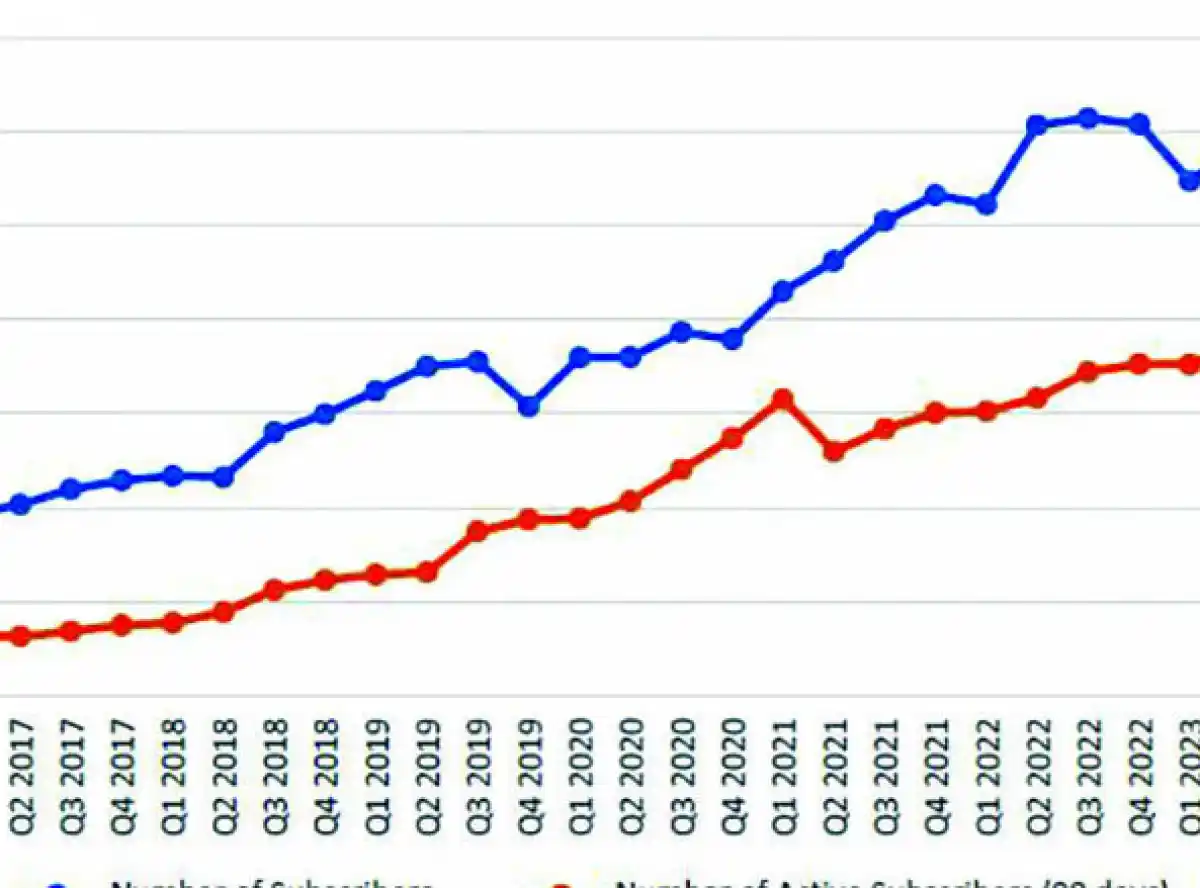

“Compared to the same period in 2023, DFS showed remarkable growth with transaction volume increasing by 32.7 percent while transaction value surged by 71.1 percent. Mobile money services, a key driver of financial inclusion, saw steady growth, with the subscriber base increasing by 2.7 percent to 13 million whereas the 90-day activity rate stood at 63.32 percent, well above the sub-Saharan regional average of 28.1 percent.

“Despite the progress, the retail payments sector faces ongoing challenges such as low participation of women in mobile money services at 41.4 percent of subscribers, limited availability of access points in rural areas and high transaction fees for some interoperable payment services,” the report reads.

President of the ICT Association of Malawi (Ictam) Clarence Gama acknowledged the significant improvement in the uptake of online and electronic transactions by Malawians, attributing it to increased acceptance of digital systems.

“There is more interest in transacting online and electronically. There has also been a good campaign promoting cashless transactions, with point-of-sale devices now common even in businesses like filling stations,” Gama said.

However, he was quick to challenge financial institutions and service providers to enhance the security of mobile transactions.

“We don’t want a situation where people are scared to transact online for fear of losing their money to fraudsters. Financial institutions should also ensure the availability of their channels,” Gama said.

In its long-term development plan, Malawi 2063, the country hopes to harness new technologies, including the use of digital platforms to ensure that information is readily available and costs associated with provision of public information are reduced.

0 Comments