Malawi’s headline inflation declined by 5.4 percentage points to 27 percent in November from 32.4 percent recorded in October 2024, figures released by the National Statistical Office (NSO) show.

This also reflects a 6.1 percentage point slowdown in the rate of increase in prices of goods and services when compared to 33.1 percent inflation rate recorded in November 2023.

This is the first time in years that Malawi’s inflation has seen such a sharp decline, taking over a year to get to levels below 30 percent.

The NSO has since attributed the decline to a disparity in the rate of increase in prices in the past 12 months especially that in November 2023 Malawi experienced a 44 percent devaluation of the Kwacha.

“The decline in the year-on-year inflation rate is mainly driven by a slower rate of increase in prices recorded in November 2024 compared to the same period last year. It is important to note that in addition to the usual factors affecting inflation, there was a sharp rise in the prices of both food and non-food items following a 44 percent devaluation in November last year. While overall prices of food and non-food items hiked in November 2024, the magnitude of the increase is significantly less than what was recorded during the same period last year resulting in the November 2024 Year-on-year inflation rate dropping substantially,” a consumer price indices report published by NSO reads.

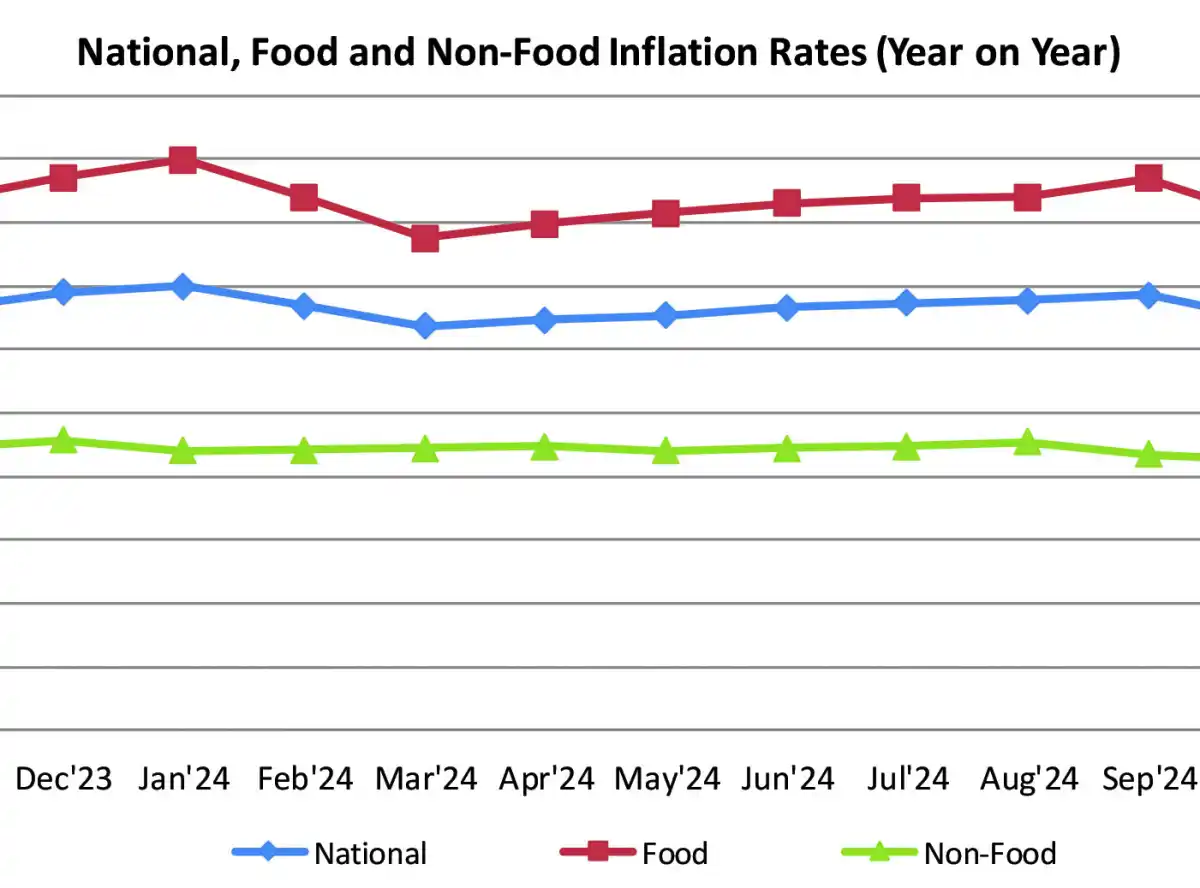

It further indicates that food inflation now stands at 33.7 percent from 40.3 percent observed last month and non-food prices, while still increasing, have registered a decline in the rate of increase from 21.2 percent to 17.2 percent.

“The national month-to-month inflation rate for November 2024 stands at 3.2 percent. Food inflation rate is at 4.1 percent while Non-Food inflation rate is at 1.7 percent. The urban month to month inflation rate is at 2.6 percent. Urban food and non-food inflation rates stand at 3.7 percent and 1.1 percent, respectively. The rural month to month inflation rate is at 3.5 percent. Rural Food and Non- Food inflation rates stand at 4.3 percent and 2.1 percent, respectively,” the report reads.

In an interview, Tuesday, Consumers Association of Malawi (Cama) Executive Director, John Kapito, said this is not reflective of what is happening on the market.

“Inflation is felt by the consumer and not by an officer who manipulates figures at the statistical office. The cost of goods has drastically gone up and that includes both food and non-food items. Consumers are currently using more money to bring in few goods than they did last month.

“We have always argued that our inflation basket, that was crafted 50 years ago, has no relevance with the current challenges and it’s sad that this inflation basket is not talking to the current situation on the market. These figures are an insult to many consumers and we expect NSO to be sensitive,” Kapito said.

Commenting on the outlook for inflation trends, economist Marvin Banda said even if food inflation was tamed, which is unlikely given the lofty price of farm inputs such as fertiliser and the constrained availability of forex, the non-food side remains high for a reason.

“How can government borrowing dissipate during an election year? So M2 should be expected to remain elevated. Fuel prices continue to face upward revisions which makes inflation likely to increase due to the pass-through mechanisms.

“What requires to be done is to let the inflation cycle pass. This doesn’t mean the cavalier misappropriation of macro-fundamentals but a realistic approach through historical context that shows that post-election cycles usually coincide with easing of inflationary pressures. Unfortunately for Malawians we need another year to realise slow growth in prices, which will however remain high,” Banda said.

0 Comments