By Kingsley Jassi:

As the economy goes through turbulences, the K2.3 trillion-worth insurance industry is bearing the shocks and is under threat of liquidity squeeze according to reports.

The nature of the industry depends on disposable income but there is fear that the high inflation rate, currently at 34.3 percent, is leaving more people with little to spare for premiums, causing increasing defaults.

One of the industry players, Smile Life Insurance Company, in its annual financial statement released this week, expressed that moving forward, the industry faces liquidity challenges.

“The performance of the Malawi economy with unprecedented increases in service and commodity prices, ending in reducing disposable incomes of Malawians and thus reducing their capacity to consume insurance products, poses a challenge to the core business of the company,” says the statement released on Monday.

Nevertheless, the company registered strong growth in 2023, making a profit of K241 million over a K24 million loss it registered the previous year.

The performance stemmed from a surge of 57 percent in gross written premium income from K1 billion to K1.6 billion in 2023, although the company suffered increased operating costs by a 46 percent margin in the year under review.

This increase in the cost of doing business as inflation continues to rise and the fear of dwindling premiums following eroded purchasing power of Malawians and businesses provides a gloomy picture which even Reserve Bank of Malawi observed in its recent Financial Stability Report.

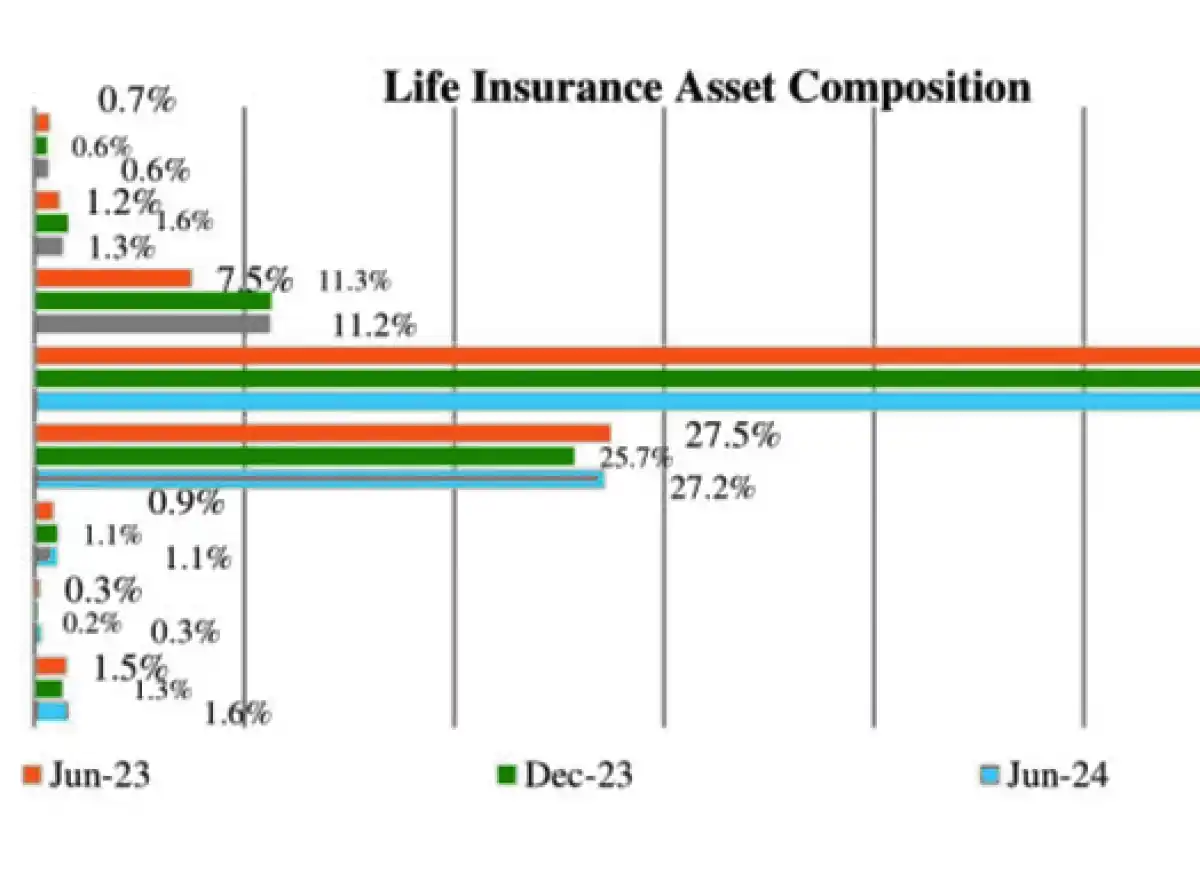

“The ratio of life insurance debtors increased to 20.1 percent as of June 2024 from 7.5 percent recorded in December 2023. On the other hand, receivables in the General insurance market continue to rise hence exposing the sector’s capital to potential credit losses and affecting the solvency position of institutions in the industry,” says the report.

The report disclosed that in the first half of the year, one life insurer and two general insurers had insufficient margin of solvency, hence posing a contagion risk in the financial system.

The central bank has challenged the insurance companies to consider diversifying their investment portfolios.

“Looking ahead, despite the challenging e c o n o m i c conditions, the insurance sector is expected to remain resilient and stable. However, the industry should consider diversifying its investment portfolio to minimise concentration risk,” says the report.

It further says on aggregate, g o v e r n m e n t securities and equities continued to dominate the total investment portfolio, representing 79 percent of the life insurance portfolio and 62.5 percent of the non-life insurance sector.

Meanwhile, the profitability of life insurers decreased in the first half of the year as the sector registered a profit after tax of K23.8 billion down from the K34.6 billion recorded in June 2023.

“The main driver of the reduction in profits is the subdued performance of the stock market, year over year, which resulted in the reduction in return on equity to 15.1 percent compared to 24.4 percent in June 2023 and 39.8 percent that was registered in December 2023,” says the RBM report.

However, it further indicates that the non-life insurance sector performed well as it reported profit after tax amounting to K7.2 billion, up from K3.4 billion posted in June 2023, driven by growth in underwriting surplus and high yields on fixed income investments supported by the prevailing high interest rates.

0 Comments